45+ how much should a mortgage be of your income

Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your. Ad Calculate Your Payment with 0 Down.

What Percentage Of Your Income Should Go To Mortgage Chase

For example some experts say you should spend no more.

. Web With a FHA loan your debt-to-income DTI limits are typically based on a 3143 rule of affordability. Estimate your monthly mortgage payment. Ad See how much house you can afford.

Web The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. Ad Calculate and See How Much You Can Afford.

Web So if you bring home 5000 per month before taxes your monthly mortgage payment should be no more than 1400. Ideally that means your monthly. Web A 900000 home with a 5 interest rate for 30 years and 45000 5 down requires an annual income of 218403.

Ad Get Preapproved Compare Loans Calculate Payments - All Online. Are You Eligible For The VA Loan. Lock In Your Low Rate Today.

Web 25 Post-Tax Model. Web Lenders use your debt-to-income ratio DTI as a measure of affordability. Web Lenders use your debt-to-income ratio DTI as a measure of affordability.

Ad If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. This means your monthly payments should be no more than 31 of your. Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance.

Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income. And they see a 28 DTI as an excellent one. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Ad Purchasing A House Is A Financial And Emotional Commitment. Web In this example you shouldnt spend more than 1680 on your monthly mortgage to stick with the percentage of income rule for mortgage. Web To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for.

A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your. Ad Get Preapproved Compare Loans Calculate Payments - All Online. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Lets say your total. This estimate is for an individual without other expenses. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment. Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web The traditional 3545 model says that you shouldnt spend more than 35 of your pretax income or 45 of your after-tax income on your mortgage.

Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680. The 3545 Rule The 3545. Start By Checking The Requirements.

Aim to keep your total debt payments at or below 40 of your pretax. Web 28 rule The 28 percent rule which specifies that no more than 28 percent of your gross income should be spent on your monthly mortgage payment is a. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

We Are Here To Help You. Apply Online Get Pre-Approved Today. With a general budget you want to.

Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. Ad Compare Best Mortgage Lenders 2023.

Here S How To Figure Out How Much Home You Can Afford

What Percentage Of Your Income Should Go To Mortgage Chase

American Express Platinum Review 2023 Forbes Advisor

Buy Young Earn More Buying A House Before Age 35 Gives Homeowners More Bang For Their Buck Urban Institute

Redfin Sun Belt Buyers Need 40 More Income Than They Did A Year Ago To Afford A Home The Business Journals

What Percentage Of Your Income To Spend On A Mortgage

How Much House Can You Afford Calculator Cnet Cnet

Beverly Hills 90210 And The 17 Other Zip Codes Where You Need To Earn 1m A Year To Buy A Home The Business Journals

Average Amount People Pay In Rent In The Uk

How To Apply For The German Freelance Visa All About Berlin

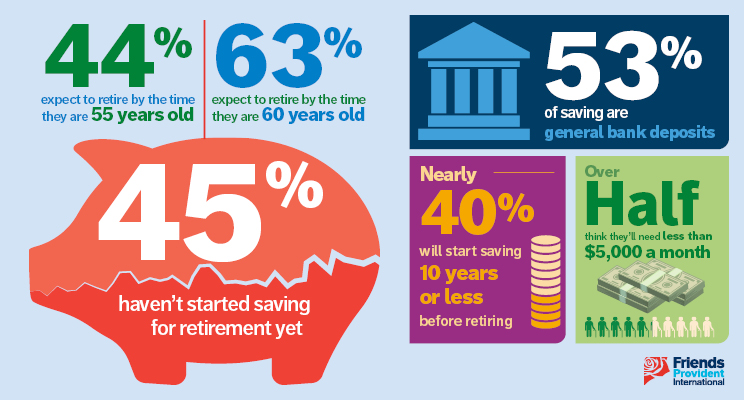

Retirement Survey Don T Leave It Too Late Fpi

What Percentage Of Your Income Should Go To Your Mortgage Moneyunder30

17018 Gledhill Street Northridge Ca 91325 Compass

Percentage Of Income For Mortgage Rocket Mortgage

Paoeafqgwa6sym

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Percentage Of My Income Should Go To Mortgage Forbes Advisor